Access the

private market in

a few clicks

Unleash the power of the private market with ease. Experience seamless access to exclusive opportunities through our digital platform. No paperwork. No hidden fees. Just click, invest, and thrive.

We take pride in delivering exceptional service tailored for individuals like you.

We strive to break down barriers by providing accessible pathways to exclusive investments, empowering everyone to grow their wealth.

We prioritize transparency as the cornerstone of trust and loyalty. It's our most valuable asset, and we uphold it in all aspects of our business.

With a personalized touch, we offer bespoke financial advice and investment opportunities that align with your unique life priorities. Your success is our top priority.

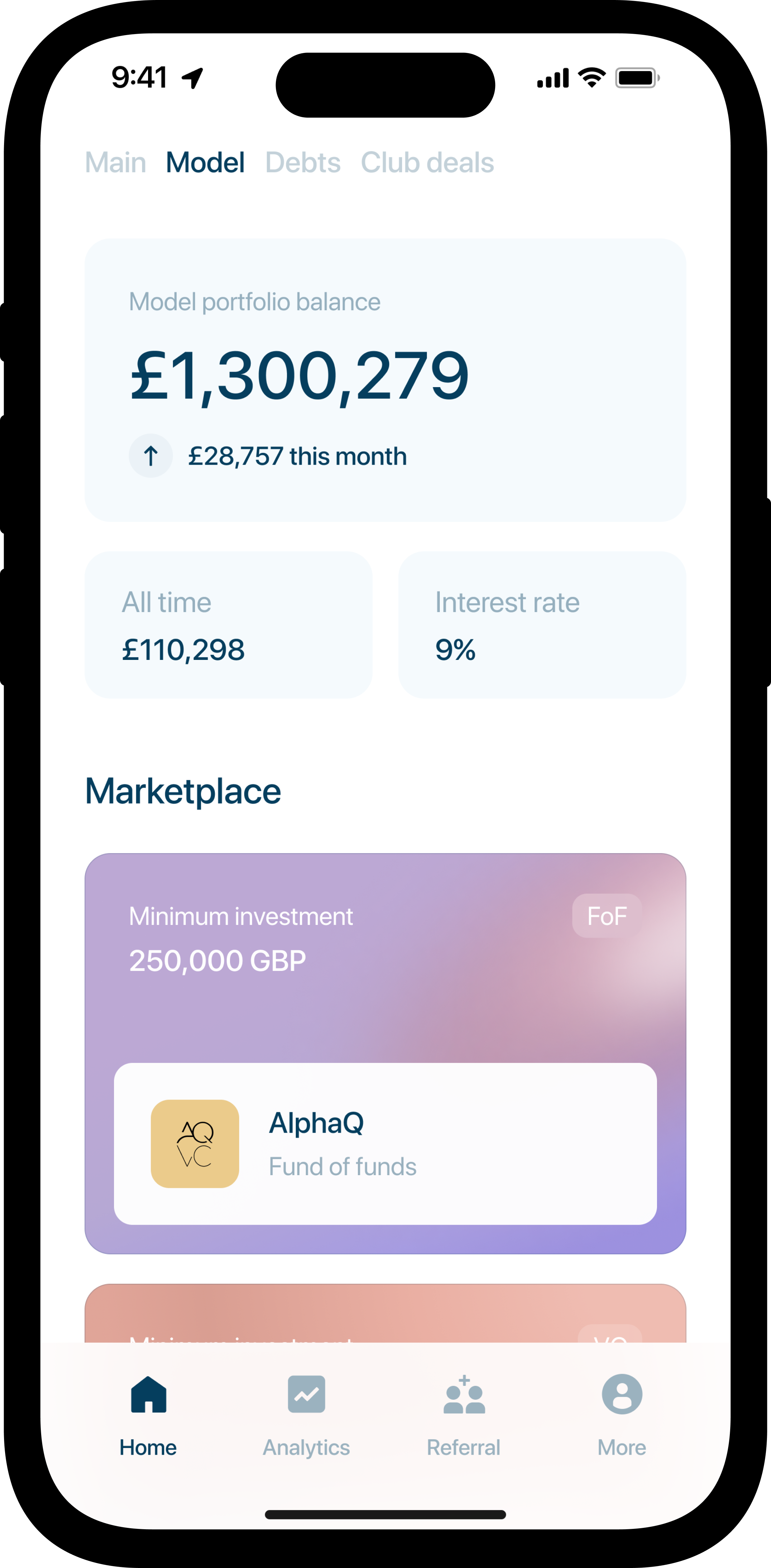

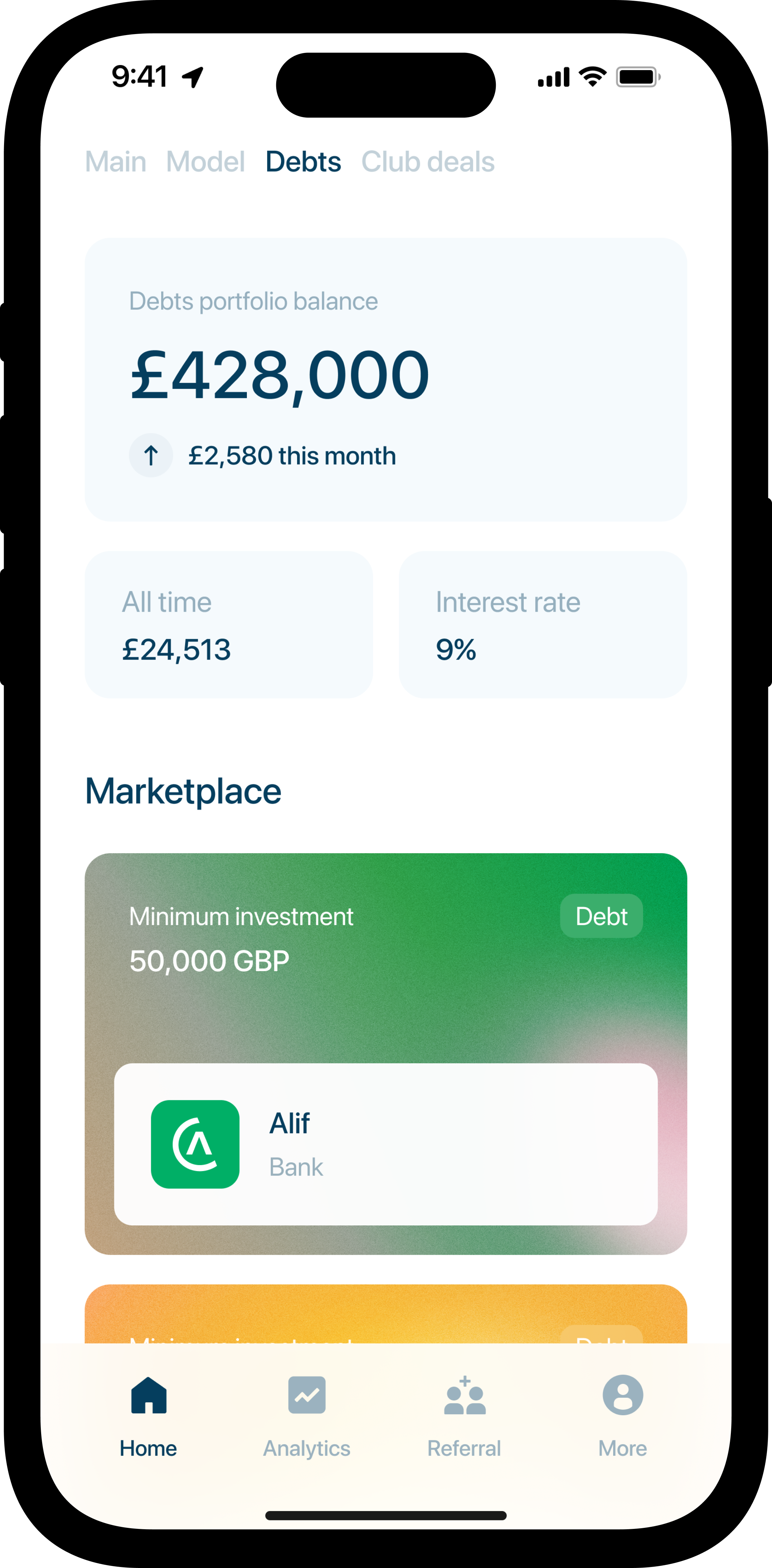

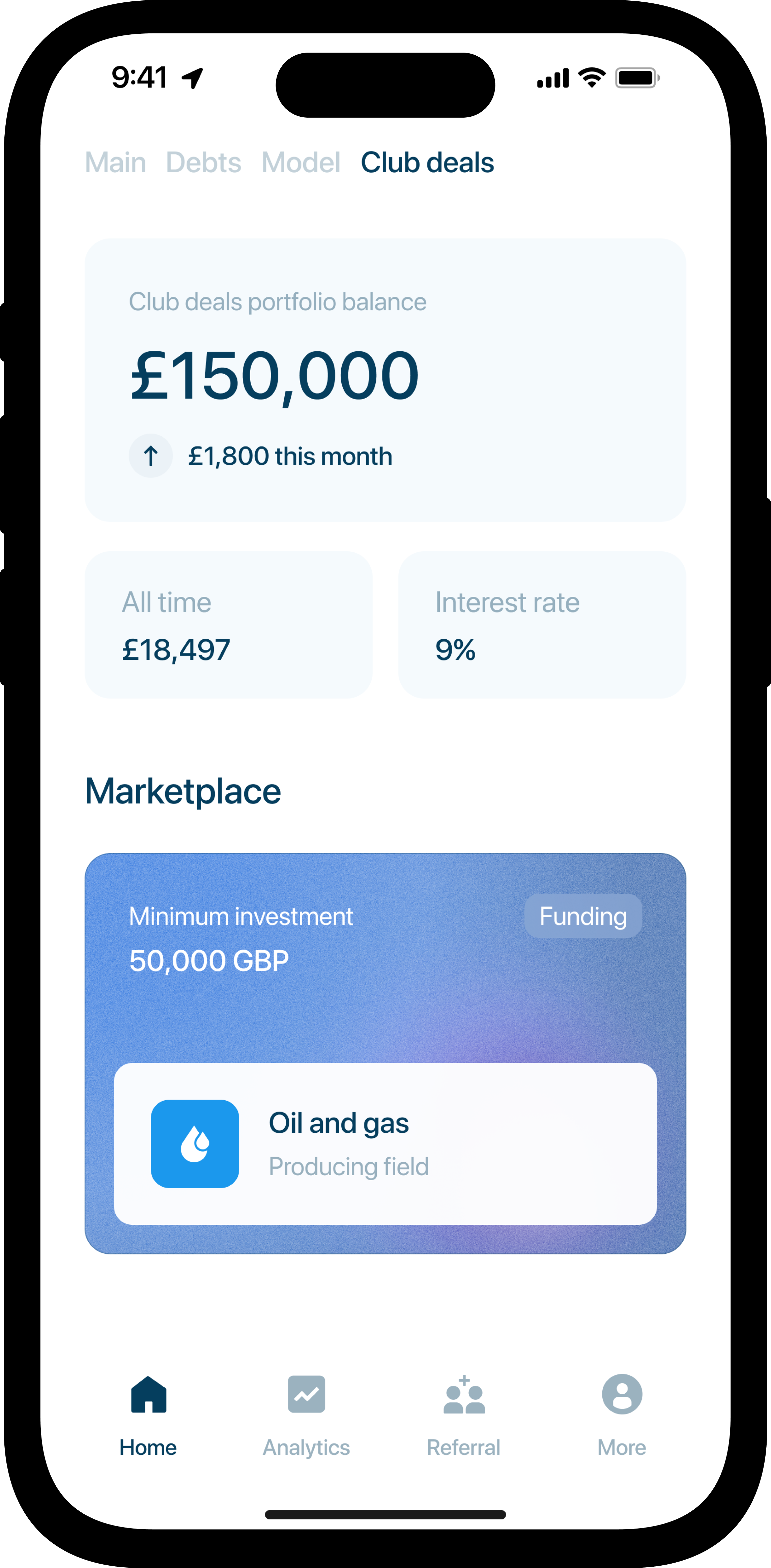

Simple and powerful app for easy investment

Unlock co-investment opportunities with top-performing and an $800M AUM Family Office, gaining access to top-tier Private Equity funds.

Dive into innovative fintech and real estate-driven debt strategies for diversified income.

Secure your spot in time-limited, one-of-a-kind deals; exclusive opportunities at your fingertips.

Stay in control by monitoring your portfolio's performance in real-time, empowering you with immediate insights for strategic decision-making.

Secure banking, personalized care

Dedicated personal manager

Our relationship managers are always ready to provide a holistic, personalized approach to your advanced financial planning.

Bulletproof security guaranteed

Your finances are secured by a partner bank in a disparate account under e-money regulations. We never lend your money.

Solution for Partner Banks

We always put our customers at the heart of our business, advancing investment banking towards a greater interpersonal approach that aims to establish new standards of service.

The accumulation of our experience and expertise delivers a contemporary, bespoke and digital banking service based on personal relationships and long-upheld conventions.

At Fortu, we enjoy hosting events for clients who fancy meeting like-minded individuals and attend programmes where we provide opportunities to share actionable insights.

Complex made simple

We analyze billions worth of investments on your behalf

Before an investment becomes part of your portfolio, our experienced investment team works diligently behind the scenes. We strive to bring you what we believe are the best opportunities, allowing you to focus on your financial goals instead of extensive research.

How it works

Explore investment opportunities

Whether you aim for income generation, portfolio growth, or a blend of both, our investments align perfectly with your objectives.

Learn expert insights and invest with confidence

From past performance to partner details, our goal is to furnish you with all the information necessary to make well-informed decisions.

Track your performance and earnings

Investments typically offer the opportunity to receive regular income, experience growth upon maturity, or enjoy a combination of both.

Anytime, anywhere, from any device

We offer simple and secure 24/7 access to your money in our mobile app or online. It's a convenient and hassle-free way to complete all your banking transactions — day or night, at home or on-the-go.

- Online banking

- Android applicationComing soon

- Light 1.jpg)

- Light 1.jpg)

- Light 1.jpg)

Meet our partners

We partnered with trusted companies who go above and beyond in what they do to deliver exceptional quality service for our clients

Latest public mentions

Become a client

For all other inquiries or manual onboarding, fill out the form below.

1/4 Accounts

1/4 Accounts